Prime Minister Anthony Albanese’s recent re-election has set the stage for significant shifts in Australia’s housing and mortgage landscape. With a renewed mandate, the Labor government is poised to implement policies aimed at enhancing housing affordability and accessibility. However, these initiatives may also introduce new dynamics to the mortgage market that both current and prospective homeowners should be aware of.

🏠 Key Housing Initiatives Under the Albanese Government

1. Expanded First Home Guarantee Scheme

Starting January 1, 2026, the government will broaden the First Home Guarantee, allowing eligible first-time buyers to purchase homes with just a 5% deposit, eliminating the need for Lenders Mortgage Insurance (LMI). This move is expected to enable over 80,000 buyers to enter the market, particularly targeting properties priced between $500,000 and $1 million.

2. Commitment to Increase Housing Supply

To address the housing shortage, the government has pledged $10 billion to construct 100,000 new homes over the next eight years. This initiative aims to alleviate pressure on housing prices by boosting supply, though experts caution that the impact may be gradual.

3. HECS Debt Reforms

From June 1, 2025, a 20% reduction in student HECS debts will be implemented, alongside raising the repayment threshold to $67,000. Additionally, new lending rules will exclude student debt from mortgage calculations, potentially increasing borrowing capacity for younger buyers.

📈 Implications for the Mortgage Market

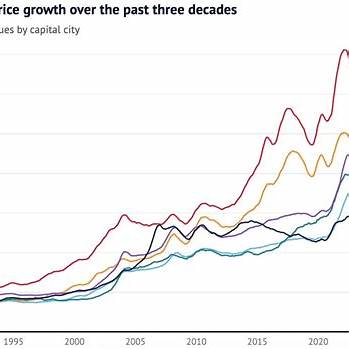

1. Potential Rise in Property Prices

The influx of first-time buyers facilitated by the 5% deposit scheme may drive up demand, particularly in the sub-$1 million property segment. Analysts predict a possible price surge of 8–15% in early 2026, especially in urban areas favoured by new entrants to the market.

2. Increased Mortgage Accessibility

The combination of reduced deposit requirements and exclusion of HECS debts from lending assessments may lead to higher loan approvals. While this enhances accessibility, it also raises concerns about borrowers taking on larger debts amid potential interest rate fluctuations.

3. Impact on Existing Homeowners

Current homeowners may experience an increase in property values, enhancing equity positions. However, those looking to upgrade may face higher purchase prices, potentially offsetting equity gains.

💡 Strategic Considerations for Homebuyers

- Act Promptly: Prospective buyers might consider entering the market before the anticipated price increases in early 2026.

- Assess Financial Readiness: Even with lower deposit requirements, it’s crucial to evaluate long-term affordability, especially in the context of potential interest rate changes.

- Seek Professional Advice: Engaging with mortgage professionals can provide personalized insights and help navigate the evolving market landscape.

The Albanese government’s housing policies are set to reshape the mortgage market, offering new opportunities and challenges. Staying informed and proactive will be key for individuals aiming to make the most of these developments

— Flourish Finance | Your Trusted Mortgage Broker